Australia offers a sophisticated financial landscape with robust regulatory oversight. The Australian Securities & Investment Commission (ASIC) authorizes all domestic forex brokers, ensuring strong consumer protection.

This regulatory framework makes Australian-based services highly attractive to both local and international traders. The country’s stable banking system supports reliable trading platforms and secure transactions.

This guide provides detailed comparisons based on actual testing and verified data. Readers will discover comprehensive evaluations of features, fees, and trading conditions to make informed decisions.

Overview of Australian Forex Trading

Australia’s position in global financial markets creates unique opportunities for currency exchange operations. The country’s sophisticated financial ecosystem supports diverse trading activities across multiple markets.

The Australian dollar, known as “the Aussie” in forex trading circles, represents the nation’s official currency. AUD/USD stands as one of the most actively traded pairs worldwide, attracting both domestic and international market participants.

Monetary policy from the Reserve Bank of Australia significantly influences forex trading australia conditions. The RBA manages the Australian dollar while promoting economic stability through strategic decisions.

This regulatory environment connects with other financial markets, including the Australian Securities Exchange in Sydney. The ASX offers equities, futures, and derivatives that complement currency trading activities.

Geographical positioning provides strategic advantages for traders targeting Asian and Pacific sessions. The robust banking infrastructure supports reliable transaction processing for market operations.

Market participants range from retail investors to institutional clients engaging in various strategies. This diverse participation creates a dynamic trading environment with substantial liquidity.

The scale of forex trading activity establishes important context for evaluating service providers. Understanding these market dynamics helps traders make informed decisions about their trading approach.

Why Choose Forex Brokers in Australia?

Operators licensed under ASIC supervision deliver superior protection mechanisms for client assets. The Australian regulatory framework sets a global benchmark for financial service integrity and security.

Professional Indemnity insurance represents a critical safeguard mandated by Section 912B of the Corporations Act. This requirement applies to all authorized financial service providers regardless of their operational scale.

The insurance protects firms during extraordinary insolvency events, though client reimbursement isn’t guaranteed. This layer of financial security demonstrates the comprehensive nature of Australian oversight.

Market participants benefit from several key advantages when selecting ASIC-regulated entities:

- Segregated client funds preventing commingling with company assets

- Transparent fee structures mandated by regulatory compliance

- Efficient dispute resolution mechanisms through formal channels

- Access to sophisticated trading technology and diverse instruments

International clients frequently seek Australian-regulated services due to the jurisdiction’s stellar reputation. The country’s stable political environment and robust legal system provide additional confidence for market operations.

These protective measures significantly reduce counterparty risk while ensuring ethical business practices. Traders gain peace of mind knowing their activities occur within a rigorously supervised framework.

Understanding Regulatory Standards (ASIC)

Established in 1998, ASIC operates as Australia’s primary financial services regulator with comprehensive oversight. The Australian Securities and Investments Commission reports directly to the treasurer and administers key legislation including the Corporations Act of 2001.

This national authority replaced the earlier Australian Securities Commission, expanding its regulatory scope. ASIC’s mandate covers insurance, corporate governance, and consumer credit protection alongside market operations.

Key ASIC Requirements

Firms seeking authorization must meet rigorous standards set by the securities investments commission. Capital adequacy requirements ensure financial stability while segregated client accounts protect investor funds.

Regulated ASIC entities face leverage restrictions of 30:1 for major currency pairs. These measures prevent excessive risk exposure for retail participants. Regular audits and financial reporting maintain ongoing compliance.

How Regulations Protect Traders

The framework established by the investments commission provides multiple safety layers. Negative balance protection prevents clients from owing more than their deposited funds.

Dispute resolution occurs through the Australian Financial Complaints Authority. This independent service offers fair outcomes for concerned market participants. Enforcement actions against non-compliant firms maintain market integrity.

Regular monitoring identifies potential issues before they impact traders. This proactive approach creates a secure environment for all participants in the financial markets.

Detailed Comparison of Leading Forex Brokers

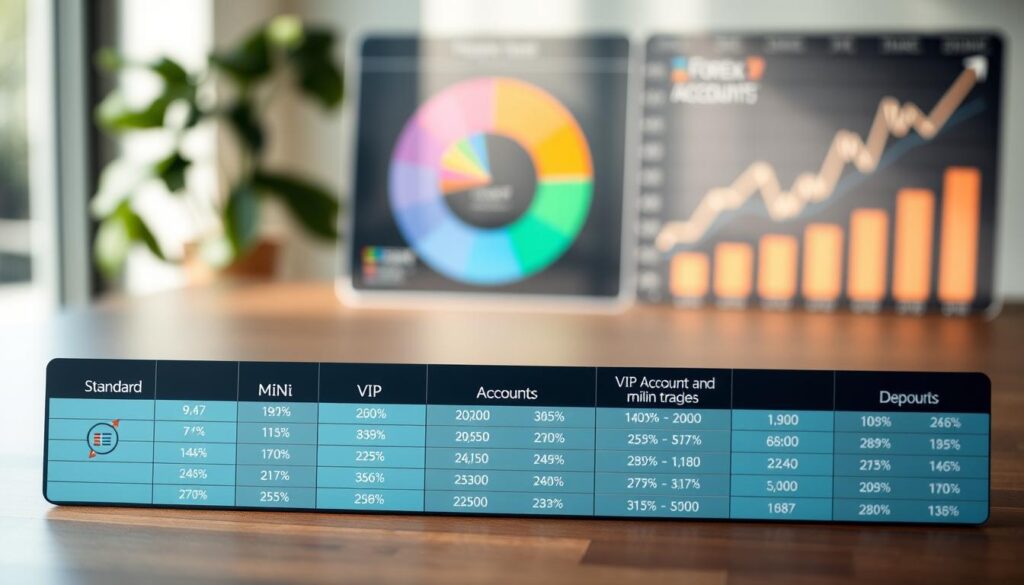

When evaluating financial intermediaries, spread structures and minimum deposits vary considerably. This analysis examines key differences among major service providers available to traders.

EUR/USD spreads show significant range across different providers. Some offer highly competitive rates starting at 0.59 pips, while others maintain wider spreads around 2.0 pips.

Minimum deposit requirements also demonstrate substantial variation. Several platforms require no initial deposit, making them accessible to new participants. Others mandate deposits from $50 to $200.

The available trading platforms differ substantially between providers. Many offer MetaTrader 4 and MetaTrader 5, while some feature proprietary systems or cTrader integration.

Account structures present another important distinction. Standard commission-free accounts contrast with raw spread models that charge commissions but offer tighter pricing.

These comparisons help traders identify suitable matches for their specific needs and capital levels. Understanding these differences supports informed decision-making when selecting a service provider.

Reviewing Top Picks: IG, Saxo, and CMC Markets

IG, Saxo, and CMC Markets represent the top-tier options available to currency traders in the region. These providers consistently earn high trust scores and industry recognition for their comprehensive offerings.

Insights on IG’s Platform

IG stands out with its exceptional mobile applications and research capabilities. The platform delivers professional-grade conditions with minimal entry barriers.

Traders appreciate the £1 minimum deposit and competitive 0.91 EUR/USD spread. Multiple global licenses contribute to IG’s outstanding 99 Trust Score rating.

Evaluating Saxo and CMC Market Features

Saxo operates three banking institutions and offers sophisticated platform tools. Its dual-approach system serves both casual and professional market participants.

CMC Markets provides extensive currency pair selection through its NextGeneration platform. The publicly-traded company maintains transparency with responsive trading technology.

Both providers feature $0 minimum deposits, making them accessible to various trader experience levels. Their robust platforms support diverse trading strategies across multiple markets.

Analyzing Trading Platforms and Tools in Australia

Choosing the right trading platform is a critical decision that affects execution quality and analytical capabilities. Different platforms serve distinct purposes, from beginner-friendly interfaces to professional-grade systems.

Major providers like Pepperstone and Fusion Markets offer multiple trading platforms including MT4, MT5, and cTrader. These tools cater to various experience levels and trading strategies.

MetaTrader 4 and 5 remain industry standards with extensive technical analysis capabilities. Advanced traders often prefer cTrader for its superior charting and algorithmic features.

TradingView integration provides social trading features and user-friendly interfaces. This appeals to beginners who need accessible trading tools.

Mobile applications ensure traders can access markets anywhere. Platform stability and execution quality significantly impact trading success beyond interface preferences.

Selection should consider strategy compatibility and required technical indicators. The right platform supports specific order types and risk management tools.

How to Verify ASIC Authorization

The process of validating ASIC licensing provides essential protection against fraudulent operators in the financial markets. Confirming regulatory status helps market participants avoid potential scams.

Proper verification ensures individuals deal with properly regulated entities. This safeguards investments and promotes market integrity.

Step-by-Step Verification Process

Begin by locating the Australian Financial Services License number on the provider’s website. Check the footer section for disclosure text containing key details.

For example, Pepperstone’s disclosure includes their ACN and AFSL numbers. These identifiers appear alongside the company’s registered address.

Next, visit the official ASIC website at asic.gov.au. Use the Professional Registers search function to validate the license status.

Common Mistakes to Avoid

Avoid accepting unofficial documents as proof of regulation. Always verify information directly through ASIC’s official channels.

Some fraudulent entities create fake regulatory websites. Ensure you’re using the genuine asic.gov.au domain for verification.

Confirm you’re dealing with the specific entity named in the license. Cloned broker identities represent a significant risk in the industry.

Examining Account Types and Minimum Deposits

Selecting the right account type is a crucial step that directly impacts trading costs and strategy execution. Providers typically offer several distinct structures to cater to different styles and experience levels.

Understanding the fee models is essential. Some accounts bundle costs into the spread, while others separate commissions from the raw market price.

Initial funding requirements also vary. A minimum deposit can range from $0 to $200, but this should not be the sole factor in choosing a broker.

Standard vs. Raw vs. Pro Accounts

Standard accounts, like Pepperstone’s, feature commission-free trading with wider spreads built into the price. This simplified structure often benefits casual traders or those with smaller amounts of money.

Raw spread accounts, such as Fusion Markets’ Zero account, charge a small commission per trade. In return, they provide much tighter spreads. This model can be more economical for active participants.

Professional accounts are designed for sophisticated individuals. Eligibility often requires proving significant assets or high-volume trading experience.

These accounts may offer higher leverage but come with the loss of certain retail protections. It’s a significant trade-off that requires careful consideration.

Best Forex Brokers Australia: Features and Spreads

Understanding total trade costs requires analyzing both spreads and commissions together. These combined expenses significantly impact profitability for active market participants.

Pepperstone’s Active Trader program offers substantial rebates. High-volume traders receive 20-30% discounts on spreads when trading 200+ lots quarterly.

Commission structures vary across providers. Fusion Markets charges $2.25 per side, while Pepperstone and Eightcap cost $3.50. Vantage offers competitive $2 round-turn fees.

Spread differences create important cost variations:

- EUR/USD spreads range from 0.0 pips at Vantage to 0.62 pips at IC Markets

- AUD/USD spreads show Fusion Markets at 0.4 pips versus wider industry averages

- Raw accounts typically offer tighter pricing but include separate commissions

Traders should calculate total costs based on their typical trade sizes and frequencies. Scalpers need the tightest spreads, while position traders might prioritize other features.

Execution quality factors like speed and slippage also affect real trading expenses. These elements combine with pricing to determine overall value.

Copy Trading and Social Trading Options

Copy trading represents a revolutionary approach where novices can automatically replicate the strategies of successful professionals. This technology enables less experienced individuals to benefit from expert market knowledge.

Platforms like Pepperstone and Fusion Markets integrate these social features. They provide access to leading copy trading services through their systems.

Exploring DupliTrade and Myfxbook

DupliTrade connects directly with MetaTrader 4 and MetaTrader 5 platforms. Users can browse performance statistics and select expert strategies to follow automatically.

The service requires a $5,000 minimum deposit for participation. This may limit accessibility for smaller accounts seeking automated solutions.

Myfxbook operates as one of the world’s largest trading communities. It offers comprehensive social features beyond simple position copying.

Traders gain access to portfolio tracking and economic calendar integration. The platform also includes forums where participants share market insights.

Social trading differs from pure copy trading by incorporating educational components. Users learn while potentially generating returns from followed strategies.

It’s crucial to understand that past performance doesn’t guarantee future results. Participants should evaluate strategy metrics carefully before committing funds.

Impact of Leverage and Risk Management in Forex Trading

The 2021 regulatory changes significantly altered how Australian participants access margin trading. ASIC now limits retail clients to 30:1 leverage on major currency pairs. This means controlling $30,000 in the market requires just $1,000 of your own money.

More volatile instruments like cryptocurrency CFDs face stricter 2:1 limits. These restrictions protect inexperienced traders from catastrophic losses. The rules align Australian standards with European regulations.

Professional accounts can access higher leverage but lose important safeguards. Participants must meet strict eligibility criteria to qualify. This trade-off requires careful consideration of personal risk tolerance.

Effective risk management becomes essential with borrowed capital. Position sizing rules and stop-loss orders help control exposure. Successful traders often use far less leverage than available.

The psychological challenges of trading with margin cannot be overlooked. Emotional discipline prevents overtrading and poor decisions. Understanding these dynamics supports sustainable forex trading practices.

Insights on Trading Platforms: MT4, MT5, cTrader, TradingView

Modern trading platforms form the backbone of every currency trader’s operations. Four major systems dominate the landscape: MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

Each platform serves different experience levels and strategy requirements. Understanding their strengths helps participants select the right tools.

Mobile Trading Advantages

Mobile versions allow market access from anywhere. Smartphone technology now supports serious trading with full functionality.

These applications provide position management and chart analysis on the go. Reliability varies between native broker apps and mobile MT4/MT5 versions.

Desktop and WebTrader Solutions

Downloadable desktop software offers maximum power and customization. Web-based platforms provide convenience without installation requirements.

Traders choose based on their technical preferences and strategy needs. Both options deliver robust features for successful market participation.

Customer Support and Educational Resources Comparison

Reliable customer support and quality educational materials are vital components for any trader’s journey. These elements significantly impact success, especially for those new to the markets or facing technical issues.

Availability of 24/5 vs. 24/7 Support

Support availability is crucial when time-sensitive problems can affect open positions. The industry standard is 24/5 coverage, matching weekday trading sessions.

Some providers offer a significant advantage with 24/7 assistance. Fusion Markets provides round-the-clock support via email, chat, and telephone.

Pepperstone also offers 24/7 help through phone, email, live chat, and WhatsApp. Their agents are noted for being patient and polite.

This constant access is essential for traders planning strategies on weekends or encountering account issues outside standard hours.

Webinars, Tutorials, and Blogs

Educational resources empower individuals to make informed decisions. The quality of these tools varies greatly between service providers.

Pepperstone delivers comprehensive “Learn to Trade” webinars, videos, and blog posts. They also provide access to The Cornelian Academy, a respected third-party educator.

IG’s DailyFx produces regular articles and videos for market participants. They even developed a standalone mobile app specifically for beginners to learn about financial markets.

Eightcap’s education consists of the Eightcap Labs blog. It covers strategies, indicators, and emotional management for traders.

These resources are invaluable tools for beginners developing their trading skills and knowledge.

Navigating Fees, Spreads, and Commission Structures

Comprehensive cost analysis helps traders identify the most economical service providers. Understanding the complete fee structure is essential for making informed decisions.

Spreads represent the difference between bid and ask prices. They form the primary cost for standard commission-free accounts. Commission-based models charge explicit fees but offer ultra-tight spreads.

Most leading providers don’t charge deposit, withdrawal, or inactivity fees. This transparent pricing benefits participants managing their trading money.

Different currency pairs carry varying spread costs. Major pairs offer the tightest spreads while exotic pairs command wider margins.

CFD trading carries substantial risk with 51-89% of retail accounts losing money. Even competitive fees cannot eliminate market volatility.

Tips for Beginners Entering Australian Forex Markets

Starting your journey in currency markets requires careful preparation and the right approach. New participants should follow these essential steps to build a solid foundation for their trading activities.

First, select a properly regulated service provider by verifying ASIC authorization. This crucial step ensures you’re working with a reputable company that follows strict financial standards.

Next, explore the trading platform thoroughly using demo accounts. These virtual environments let you practice strategies without financial risk. Test all features including mobile apps and order types.

When ready to fund your account, consider convenient methods like PayPal. This option supports multiple currencies and offers international accessibility for depositing money.

- Develop a written plan defining your strategy and risk parameters

- Start with small positions using micro lots appropriate for beginners

- Practice emotional discipline by following your plan consistently

You can begin trading with as little as $100 at providers offering low minimum deposits. Remember that sustainable success requires patience and continuous learning. Even experienced traders face losses, so maintain realistic expectations throughout your journey.

Final Reflections on Choosing Your Ideal Forex Broker

Making an informed decision about which platform to use depends on understanding how subtle differences impact long-term trading outcomes. While providers offer similar core features, small variations in pricing and execution quality accumulate significantly over time.

Regulatory compliance remains non-negotiable. Always verify ASIC authorization before committing funds. This ensures essential protections for your trading activities in the Australian market.

Consider your individual needs when selecting a service. Beginners benefit from educational resources, while experienced participants may prioritize advanced tools. Australian residents should also consult tax professionals about reporting requirements.

The ideal choice varies for each person. Take time to test platforms thoroughly and ensure your selected provider aligns with both current and future trading goals.