Admiral Markets Review

Choosing which platform to put your money on can be a more difficult and time-consuming process than you might expect. There are a variety of online brokers available, all of which you can access from any device at any time and from any location, but they are not all the same.

As a result, it’s reasonable to inquire about Admirals’ solutions and the feedback received from users who have already used this platform to conduct online trading.

In This Guide

- 1 What is Admiral Markets?

- 2 Is Admiral Markets a Scam?

- 3 Opening an Account with Admiral Markets

- 4 How does Admiral work?

- 5 Admirals trading Platforms

- 6 Admiral Markets Account Types

- 7 Admirals: Costs and Commissions

- 8 Admiral Markets Pros & Cons

- 9 Admirals Markets Reviews and Opinions

- 10 Conclusion

- 11 Frequently Asked Questions

Do you want to know if Admirals is the right broker for you? By reading this Admiral Markets review, you will be able to make a comparison with other licensed brokers who could be a viable alternative to consider.

What is Admiral Markets?

Admirals is an English investment firm that was founded in 2001. The Admiral Markets brand will be rebranded as Admirals in 2021 to commemorate the company’s 20th anniversary.

In addition to the name change, the company recently announced that interesting news in terms of services offered and integrated solutions to the existing platform is on the way.

The rebranding, according to the official website, aims to turn the broker into a real financial hub, expanding the range of products and services available to users.

Admirals offers CFD trading on the following assets:

- Indices: they are 19 cash and 24 futures;

- Forex: over 50 pairs available;

- Raw materials: of which 6 metals, 4 related to energy, 7 in the agri-food sector and 11 futures;

- Stocks: over 3,000 titles from around the globe;

- ETFs: More than 300 funds are tradable.

- Cryptocurrencies: 22 digital / traditional currency pairs and 10 cryptocurrency pairs;

The offer appears to be well-diversified and substantial. You will be able to trade on a variety of markets using CFD trading strategies.

Admiral Markets’ services are available on the most popular devices on the market. Ranging from desktop versions for computers to apps for smartphones and tablets, regardless of operating system.

In fact, the platforms on this broker are compatible with both Android and IOS.

Is Admiral Markets a Scam?

Admiral Markets appears to be a safe broker, having been registered and authorized to provide online trading services in a number of countries, including Europe.

In fact, the English company is regulated by the Cypriot financial control authority and the EU CySEC, with registration number 201/13.

Admirals complies with specific financial security agreements in accordance with CySEC regulations, in order to protect investors and the broker himself.

Let’s take a look at the most important:

- Client Fund Segregation: User accounts are held in an EU regulated credit institution and are completely separate from the broker’s accounts.

- Negative balance protection: this policy compensates the broker for deficits in the event of a negative balance of customers, both retail and professional, with a maximum ceiling of 50,000 euros for the latter.

- The Investor Compensation Fund (ICF): ensures that customer complaints are covered up to a maximum of 20,000 euros.

- Insurance coverage up to 100,000 euros: Admirals has established an insurance policy to protect its customers’ capital as of March 1, 2021.

Admiral Markets is clearly a trustworthy broker, but for completeness’ sake, you can consult a list of the best online brokers available, with the key features highlighted, in order to make an informed decision.

Opening an Account with Admiral Markets

Getting into an Admirals account is simple and quick. Here are the steps to start trading with Admiral Markets:

- From the broker’s homepage, click the blue “Start Trading” button;

- Fill out the form with the required information to create an account;

- Verify your account to finish the registration process.

- Choose the type of account among the 5 available;

- Make your first deposit and wait for your funds to be transferred;

- Use the demo account to familiarize yourself with the platform’s tools and layout.

Begin the process

To begin the process of registering for an Admirals trading account, simply click “Visit Admirals” button on our site that’ll take you to the official website. On the AM site click the blue button that says “Start Trading” button.

Following that, a form will appear for you to fill out with the personal information required for the account subscription; you can also speed up the process by connecting your Google or Facebook account.

If you want to continue with the data collection, you’ll need to enter an e-mail address that you use frequently and an 8-character password to protect your account. Choose your password carefully.

After you’ve entered your information and verified the email address you received, you’ll need to respond correctly to the KYC (Know Your Customer) model set forth by anti-money laundering and terrorist financing regulations, after which you’ll be able to proceed with the creation of your Admirals account.

How does Admiral work?

Let’s take a closer look at how Admiral Markets operates and what its technical and executive characteristics are.

As an ECN / STP platform that primarily focuses on CFD trading tools, Broker Admirals guarantees excellent order execution.

Brokers who offer straight through processing (STP) are market intermediaries who send client orders directly to the liquidity provider.

Except for the spread, which is one of the few sources of income for the STP broker, market prices are not influenced by the broker.

As a result, the benefits of using a STP broker like Admirals are as follows:

- Prices in line with the market;

- Fast execution of orders;

- Less risk of conflict of interest.

However, there may be some drawbacks to a broker’s order execution model, so it’s critical to fully comprehend this before making a deposit.

As a result, it’s possible that a Market Maker “disguised” as a STP broker is using a mixed system or a liquidity provider that isn’t completely transparent.

Price requotes during periods of high volatility are yet another disadvantage of this type of financial intermediary.

As we’ve seen, almost all of Admiral Markets’ accounts are structured as CFD accounts.

The “Invest” account, on the other hand, is for those who want to implement long-term strategies by purchasing securities in the real world.

Retail clients’ expected leverage for CFD trading accounts is a maximum of 1:30, as required by ESMA regulations.

Professional accounts, on the other hand, can utilize leverage of up to 1: 500.

Admirals trading Platforms

The broker offers the MetaTrader 4 and MetaTrader 5 platforms, which are well-known among experienced traders.

These are the most widely used non-proprietary trading platforms (provided by a third party) by professional traders around the world, which come with all of the necessary tools but are not suitable for novice traders.

Admiral Markets Account Types

The types of account you get on Admirals depend primarily on the trading platform with which you choose to use. You can select the type of account you want to subscribe to based on which of these platforms you want to use.

Let’s take a look at the MetaTrader 4 accounts that are available on Admirals:

- Trade.MT4 account;

- Zero.MT4 account.

You can sign up for the following trading accounts if you want to use the MetaTrader 5 platform:

- Trade.MT5 account;

- Invest.MT5;

- Zero.MT5.

The Zero account

This account requires a minimum deposit of $100 and allows you to trade in CFD mode over 60 assets. The value of the spreads, which start at 0 pips, is the main distinguishing feature of this type of account.

The Invest Account

The Invest account, which can be accessed through the MetaTrader 5 platform, allows DMA operations, which means you can buy real shares and ETFs directly from the market. In this case, the minimum deposit is only $1, and financial leverage is avoided by trading directly on stocks and exchange-traded funds (ETFs). This type of account has no overnight commissions and is specifically designed for investors who are interested in long-term trading strategies.

Admirals has a broker profile for experienced traders, are you sure it’s the right one for you?

Admiral Markets Pro is a trading account for professionals.

When it comes to professional investor accounts, Admirals has a dedicated solution that is also available to European traders.

You must meet the following financial requirements in order to gain access to the Admiral Markets Pro account:

- Have a minimum investment portfolio of € 500,000;

- Carry out an average of 10 transactions per quarter in the last year;

- The trader has significant experience in the investment and finance industry.

The Admirals Account for Professionals offers cost savings and a financial leverage of 1: 500 on forex trading.

Admirals: Costs and Commissions

Let’s take a look at Admiral Markets’ cost and commission structure to get a better idea of how much trading operations for each type of asset cost.

In general, this broker’s offer is competitive, with no excessive costs in comparison to the competition.

Let’s look at the costs and commissions in more detail:

- Admirals is a broker that is in line with the trading offer on the market because the costs associated with the Spread are very low.

- The Spread’s value varies depending on the assets you invest in and the type of account you subscribe to.

The data relating to the spread of the major assets is as follows:

| Symbol | Spread (in pips) |

| EUR / USD | 0.00008 |

| USD / JPY | 0.01 |

| GBP / USD | 0.0001 |

| DAX30 | 0.8 |

| GOLD | 0.20 |

| BRENT | 0.03 |

| DowJones Industrial 30 | 1.7 |

Admiral Markets Pros & Cons

We can draw up what may be the main Pros and Cons of Admirals after analyzing the functioning and seeing the opinions and opinions of users.

Admiral Markets, as an ECN / STP broker with no Dealing Desk, assumes all of the characteristics of this type of intermediary, including its benefits and drawbacks.

Many investors prefer Market Maker brokers because of their greater flexibility, but traders who want to automate their trading activities prefer ECN / STP brokers because of their high execution speed.

Admirals, on the other hand, appears to be a fairly trustworthy broker, having been granted permission to operate in Europe despite not being directly supervised by Italian authorities.

It does, however, have sufficient authorizations to eliminate the possibility of fraud.

Here’s a quick rundown of the main pros and cons of Admiral Markets:

Pros / Cons

- Authorized and regulated broker

- Ready for automatic trading with EA

- Low costs and minimum deposit

- Lack of Social Trading

- Rollover deposit and currency conversion fees

Admirals, like most top-tier brokers, offers a free demo account, but it is only available for 30 days. This is not enough time, especially for a beginner.

Admirals Markets Reviews and Opinions

Admiral Markets has shown that it is attentive to the needs of investors, making it a good option for traders looking for a reliable and professional STP broker.

However, it might be interesting to learn how Admirals’ services are rated by users who have had operational experience with the broker.

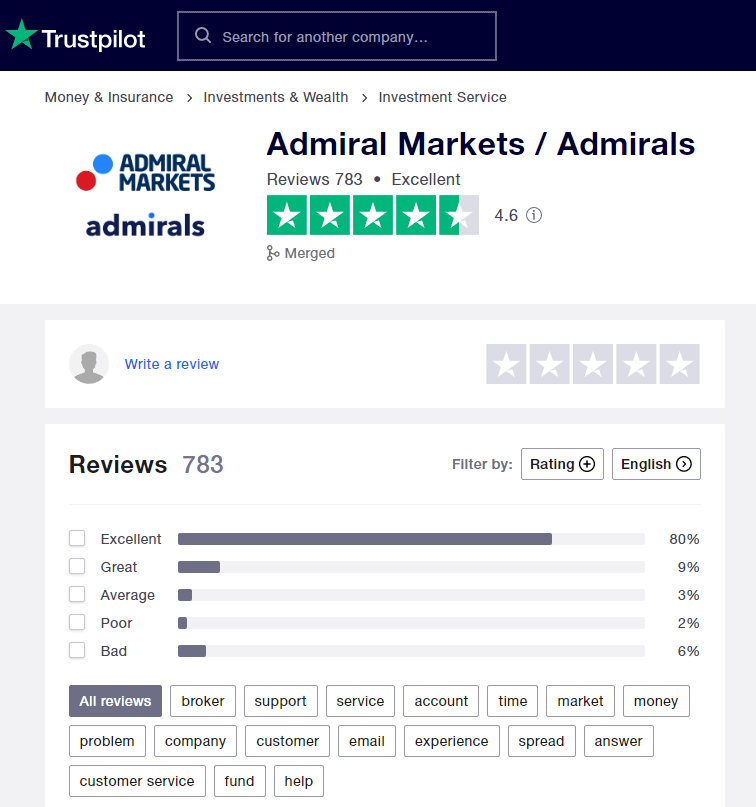

The general sentiment of Admirals users can be found in the reviews posted on TrustPilot.

The users’ overall opinion is positive, with a score of 4.6 out of 5.

Indeed, out of a total of 783 reviews, 80% of users stated that they had a very positive experience with this broker.

Admirals’ service received a “bad” rating from only 6% of users.

Reading some of the negative reviews, it’s clear that there are some technical issues with deposits and withdrawals, as well as customer service that isn’t always up to par.

Nonetheless, it should be noted that many of Admiral Markets’ clients praise the training sector in particular as one of the positive aspects.

These are people, on the other hand, who have prior experience and did not have to start from scratch.

Building enough trading knowledge with only a 30-day demo account available turns out to be quite difficult!

Conclusion

It is obvious that the best broker will differ depending on the type of investment experience you seek.

Obviously, one’s knowledge influences their decision.

This is clear in the case of Admirals.

In fact, a significant portion of its users have prior trading experience and thus are not required to use its training program.

Let us now attempt to provide a succinct answer to the frequently asked question: is it worthwhile to invest in Admiral Markets?

Admirals is a good broker for a specific type of trader.

Admirals is, in our opinion, worthwhile for experienced traders looking to trade in the short term.

Scalping is legal in some geographic areas and a fast STP broker like Admiral Markets can be a good solution.

We also discovered that user sentiment is generally positive, implying that the service is of high quality.

At ForexOnlineBrokers, we would advise all novice investors who are just getting started with these types of instruments to avoid this broker. Instead look into other options that will allow them to improve their trading experience while reducing their risk of losing money.

Frequently Asked Questions

What is Admiral Markets?

Admiral Markets is a financial brokerage firm with no dealing desk. It differs from Market Maker brokers in that it acts as an intermediary between the investor and the liquidity provider. Admiral Markets allows you to trade on the major financial markets.

How does Admiral Markets work?

By registering on the Admiral Markets website, you can use a demo account to get a feel for the platform, which includes all of the real-world features of CFD trading.

You can invest in a variety of assets by registering a real account with the broker and making a first deposit of at least €100.

Is it worth investing with Admiral Markets?

Yes. You can invest with Admiral Markets using derivative instruments like CFDs. You can also win by utilizing the STP broker's typical speed of execution.

Login

Register